Menu

- Privacy Policy

- Terms Of Service

- About

- Contact

How to buy Stellar lumens

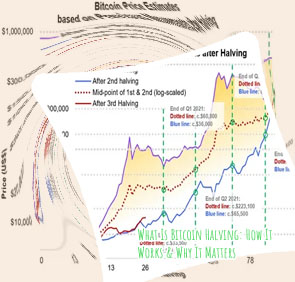

Bitcoin (BTC) remains at the forefront of discussions as the cryptocurrency market continues to evolve due to its unique setup. Bitcoin’s unique economic model, driven by its halving events, has intrigued the general financial world. What happens when Bitcoin is halved? In the past, halving cycles have established recurring price patterns for Bitcoin. Market participants often price in the effective reduction in inflation months in advance, and this impending momentum has historically propelled Bitcoin into a prolonged bull market. Ultimately, the fundamental changes in Bitcoin's supply are real and play a crucial role in defining Bitcoin as a scarce digital asset. In crypto circles, there is often talk of four-year cycles characterized by rapid price increases and decreases over two-year periods.

Bitcoin halving is vital to its network. It ensures Bitcoin’s scarcity by limiting its supply. Halving events happen every four years, and they have historically caused bull runs. Every halving event increases Bitcoin’s value by reducing the block reward. Also, it reduces miners’ profitability while causing Bitcoins’ scarcity. Previously, Bitcoin’s halving generated excitement and optimism among crypto enthusiasts. However, various factors influence the market dynamics, and the results of future halving events might differ. But Bitcoin halving will remain essential to maintain the cryptocurrency’s value and integrity. What is bitcoin halving? Bitcoin halving is a prominent event that affects the entire crypto market. It creates anticipation among the Bitcoin market’s players because they have historically correlated it with bull runs. A market bull run is a prolonged duration of market optimism and price appreciation. When the block reward reduces, it limits selling pressure among the miners. And this can lead to an imbalance between supply and demand, propelling the price upwards.